In 2023 the SRB made a request to banks for resolution reports with the aim of collecting information for drawing up and implementing resolution plans, including calibrating Minimum Required Eligible Liabilities (MREL) targets from [115] banking groups in scope of the exercise.

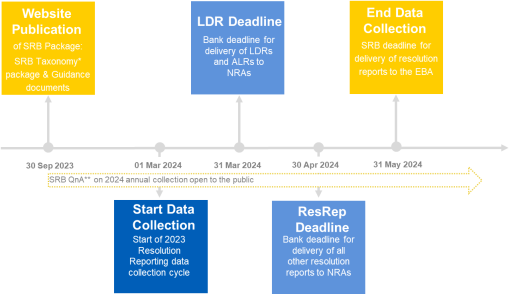

For 2024, the SRB once again highlights the importance of high quality, complete and timely data submissions. The ability to provide the necessary data to support the implementation of the resolution strategy, is a key resolvability issue, to be adequately considered by banks’ top management. To ensure banks meet the reporting deadlines (see timeline below), the SRB recommends that all banks implement the following measures:

To support high quality and complete data, the resolution reports should be submitted in line with the published guidance, with validation checks performed by the bank ensuring, among others, reconciliation with its FINREP and COREP regulatory reports (where applicable) as detailed in the List of additional data checks below.

Banks should ensure that they have the necessary IT processes in place to facilitate a timely, controlled and robust reporting process generating consistent and reliable results.

Data quality and availability on time are key items to consider within the resolvability assessment. In this context, the SRB can consider the failure to comply with the information requirements as an impediment to resolvability, potentially significant. It is therefore important that the quality of and deadlines for the resolution reporting submissions are respected.

The SRB, in collaboration with the National Resolution Authorities (NRAs), is starting its annual Resolution Reporting Data Collection exercise. During the 2024 edition, the collection will be based on data as at 31 December 2023. The process will integrate lessons learned from the previous exercises and take into account the feedback received from NRAs as well as the industry.

The scope of the reports has evolved to reflect the needs of resolution planning, while limiting the burden of reporting for banks. Nevertheless, the SRB retains the flexibility to request additional information wherever and whenever it deems necessary to do so.

As concerns the reporting perimeters, (Sub)-Consolidated views are based on the prudential or resolution scopes of consolidation, whereas Resolution Groups are to be defined by Internal Resolution Teams, in collaboration with the respective institutions.

Overview of SRB Resolution Reporting Requirements for 2024

The SRB is responsible for centralising resolution reporting for banks under its remit, before these are transferred to the European Banking Authority (EBA).

Note that the reports listed below will be collected by the SRB from NRAs exclusively in XBRL format. As was the case in previous collections, NRAs will communicate banks’ reporting requirements, as determined in collaboration with the SRB.

| EBA Template number | EBA Template code | Name of the template or group of templates | EBA Short name | SRB Replacement Report | SRB Reference | Reporting deadline |

|---|---|---|---|---|---|---|

| ENTITY INFORMATION, GROUP STRUCTURE, CONTACTS | ||||||

| 1 | Z 01.00 | Organisational structure | ORG | N/A | N/A | 30/04/2024 |

| INFORMATION ON ON- AND OFF-BALANCE SHEET ITEMS | ||||||

| 2 | Z 02.00 | Liability Structure | LIAB | LDR | T 01.00 | 31/03/2024 |

| 3 | Z 03.00 | Own funds requirements | OWN | LDR | T 02.00 | 31/03/2024 |

| 4 | Z 04.00 | Intragroup financial connectedness | IFC | LDR | T 03.01-.03 | 31/03/2024 |

| 5.1 | Z 05.01 | Major counterparties (Liabilities) | MCP 1 | N/A | N/A | 30/04/2024 |

| 5.2 | Z 05.02 | Major counterparties (off-balance sheet) | MCP 2 | LDR | T 12.00 | 31/03/2024 |

| 6 | Z 06.00 | Deposit insurance | DIS | N/A | N/A | 30/04/2024 |

| CORE BUSINESS LINES, CRITICAL FUNCTIONS AND RELATED INFORMATION SYSTEMS AND FINANCIAL MARKET INFRASTRUCTURES | ||||||

| Critical functions and core business lines | ||||||

| 7.1 | Z 07.01 | Criticality assessment of economic functions | FUNC 1 | CFR | T 20.01-.05, T 98.00 | 30/04/2024 |

| 7.2 | Z 07.02 | Mapping of critical functions to legal entities | FUNC 2 | N/A | N/A | 30/04/2024 |

| 7.3 | Z 07.03 | Mapping of core business lines to legal entities | FUNC 3 | N/A | N/A | 30/04/2024 |

| 7.4 | Z 07.04 | Mapping of critical functions to core business lines | FUNC 4 | N/A | N/A | 30/04/2024 |

| 8 | Z 08.00 | Critical services | SERV | N/A | N/A | 30/04/2024 |

| FMI services - providers and users | ||||||

| 9 | Z 09.00 | Users, providers and users - mapping to critical functions | FMI 1 | FMIR | T 30.00-T33.00 | 30/04/2024 |

| Information systems | ||||||

| 10.1 | Z 10.01 | Critical Information systems (General information) | CIS 1 | N/A | N/A | 30/04/2024 |

| 10.2 | Z 10.02 | Mapping of information systems | CIS 2 | N/A | N/A | 30/04/2024 |

| OTHER SRB REPORTING TEMPLATES (included in EBA 2.10 Reporting Framework) | ||||||

| Liability Data Report | ||||||

| N/A | N/A | Identification of the report | N/A | LDR | T 99.00 | 31/03/2024 |

| N/A | N/A | Securities (Including CET1, AT1 & Tier 2 Instruments; Excluding intragroup) | N/A | LDR | T 04.00 | 31/03/2024 |

| N/A | N/A | All Deposits (excluding intragroup) | N/A | LDR | T 05.01 | 31/03/2024 |

| N/A | N/A | Other financial Liabilities (not included in other tabs, excluding intragroup) | N/A | LDR | T 06.01 | 31/03/2024 |

| N/A | N/A | Derivatives | N/A | LDR | T 07.00 | 31/03/2024 |

| N/A | N/A | Secured Finance, excluding intragroup | N/A | LDR | T 08.00 | 31/03/2024 |

| N/A | N/A | Other Non-Financial (not included in other tabs, excluding intragroup) | N/A | LDR | T 09.00 | 31/03/2024 |

The SRB has highlighted the overlap between the EBA and the SRB reporting requirement. Where an SRB Replacement Report exists (e.g. Z 02.00 is replaced by T 01.00), ONLY the replacement report should be sent by the bank (T 01.00).

Where no SRB Replacement Report exists (e.g. Z 10.01), then the Z report needs to be sent (if requested by the NRA/SRB from the reporting entity).

With the exception of T99.00, the "Other SRB Liability templates" should only be filled when explicitly requested by the NRA/SRB (granular reporting of POE files).

The reporting deadline for the LDR is 31/03/2024; for all other reports 30/04/2024.

Below are links to the Guidance documents for SRB-originated resolution reports:

Data Quality

The SRB has elaborated additional data checks (referred to commonly as Level 3 checks), which aim to enhance the quality of resolution data reported in accordance with the Commission Implementing Regulation 2018/1624, as extended by the SRB Guidance published above. The SRB applies these checks alongside other qualitative checks on data received. The list below may be updated by the SRB as needed. The SRB reserves the right to run additional data checks, not covered in the list below, on a case-by-case basis.

SRB Level 3 data quality checks v1.04 (last updated on 18 December 2023)

The SRB strongly encourages reporting entities subject to resolution reporting requirements to apply these data checks

SRB Taxonomy Extension

The SRB’s taxonomy publication represents an SRB extension to the EBA 3.3 Reporting Framework. This extension contains minor changes to the EBA taxonomy and validation rules which the SRB deems necessary to facilitate the data collection in XBRL format in 2024:

• Expand the current EBA entry point RESOL to the 4 SRB entry points (LDR, CFR, FMIR and CIR);

• Improve data quality and data collection efficiency by expanding the list of Validation rules and modifying certain existing validation rules.

Banks are reminded that they are expected to reflect both the EBA 3.3 XBRL taxonomy (available on the EBA website) and the SRB taxonomy extension (see below) when building their XBRL reporting systems for 2024.

SRB Taxonomy extension documents:

- srb_res_filing_rules_v7.0

- ResRep2024_Validation_Rules v5.0

- ResRep_8.0.2_fullTaxonomy_v20231009

- ResRep_8.0.2Taxonomy package_withoutdependencies

At the request of some national resolution authorities, we have now published an alternative taxonomy package which contains only the SRB extension without the dependencies that are mentioned in the change log of the full Taxonomy package.

Therefore, either the ResRep_8.0.2_fullTaxonomy_v20231009 (with all dependencies, e.g. EBA, Eurofiling, etc) OR the ResRep_8.0.2Taxonomy package_withoutdependencies may be used, depending on your needs.

SRB Taxonomy extension – sample XBRL instances:

The XBRL instances in the zip file below are provided as examples and fulfil the XBRL3.3 specification and ResRep 8.0.2 taxonomy (which is an extension of EBA 3.3).

These files pass the Level 1 & Level 2 data validations but have not been configured to pass the Level 3 checks described in the Guidance documents.

All values stored in the XBRL facts are fictitious.

MREL_TLAC quarterly reporting

The SRB will collect quarterly MREL_TLAC reports, in line with the EBA ITS on disclosure and reporting on MREL and TLAC. This covers data mainly on eligibility under the MREL and TLAC framework such as (a) amounts, (b) composition and maturity, (c) creditor ranking and (d) contract-specific information. The SRB will use information to set and monitor compliance with MREL targets. Banks are therefore expected to deliver these reports to NRAs in line with the reporting requirements stipulated in the ITS. Questions on MREL_TLAC disclosure and reporting should be raised directly with the EBA or with the NRA responsible for the reporting entity.

Additional Liability Data Collection (Reporting in Excel format!!)

In addition to the SRB-specific MREL/TLAC report outlined above, the SBR has decided to request annually –on a case by case basis- complementary information that is necessary for setting MREL. In particular, such information is requested from resolution groups with a) Multiple Point of Entry strategy or b) mortgage credit institutions under certain conditions to identify interconnections within the group.

The data request for the Additional Liability Report is reflected in a dedicated reporting template and related Guidance to be used for the 2024 data collection:

Timeline for the 2024 Resolution Reporting data collection process

*Banks are expected to reflect both the EBA 3.3 XBRL taxonomy (available on the EBA website) and the SRB taxonomy extension (published on the SRB website) when building their XBRL reporting systems for 2024.

**QnA organised by SRB will be limited to questions on SRB-originated reports (LDR, CFR, FMIR). Questions on other CIR reporting requirements should be raised with the EBA.