- Home

- News & Media

- Blog

- All in on bail-in: how the SRB and banks are testing bail-in and making it operational

All in on bail-in: how the SRB and banks are testing bail-in and making it operational

The bail-in tool was introduced in the EU as a response to government bail-outs during the great financial crisis of 2008-2009. The concept is that, rather than the taxpayer, owners and creditors of banks bear losses and, if necessary, recapitalise the failing bank. Bail-in supports market discipline, counteracts the “too big to fail” problem and promotes financial stability, so that banks can better support the economy with their lending and credit services.

This blog post looks at where we stand on operationalisation of the bail-in tool in the Banking Union and more widely in the EU.

I will focus on three areas: banks’ bail-in playbooks; how banks are testing bail-in; better transparency on bail-in decisions and execution.

1. Bail-in playbooks prepared by banks

Lawmakers endorsed the EU bank resolution framework in 2014 and the bail-in regime became effective in 2016. Since then, the SRB, in cooperation with national resolution authorities (NRAs), has worked closely with banks to make the bail-in tool operational. In parallel, banks built up their Minimum Requirement for Own Funds and Eligible Liabilities (MREL) capacity to comply with the final targets by 1 January 2024. MREL is set by resolution authorities to ensure that a bank maintains at all times sufficient eligible instruments to facilitate the implementation of the preferred resolution strategy. The building up and maintenance of MREL capacity, in terms of quantity, quality, governing law, and appropriate location of MREL instruments, therefore plays a key role in improving a bank’s resolvability.

Under EU law, banks must be able to support the execution of a bail-in. To achieve this, all SRB banks earmarked for bail-in need to develop a playbook. This operational document, owned by the bank, is expected to address all internal and external actions that must be carried out by, or on behalf of, the bank to effectively apply the bail-in tool. It also describes the needed data provision and ICT processes. To support this, the SRB provided banks with guidance to develop playbooks and establish their bail-in data capabilities in 2020 which, together with another guidance in 2021 on bail-in for international debt securities, complements the SRB Expectations for Banks (EfB) published in 2020.

When we compare the first versions of the bail-in playbooks, received in 2021, to the current iterations, we notice material improvements, which take into account the outcome of the SRB’s review and feedback. The same is true for the banks’ bail-in data (ICT) infrastructure. Today, most of the playbooks generally do not show material gaps in the process descriptions or similar issues, showing that banks have considerably enhanced their ability to support bail-in execution. However, many banks need to continue improving their playbooks and the underlying processes and infrastructure and, in particular, their data systems, so that the entire bail-in process can be executed, if and when necessary.

2. Bail-in testing exercises by banks

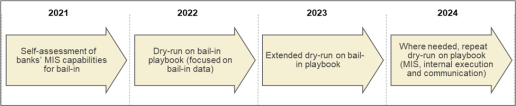

SRB banks have been asked to perform testing exercises under the steer of the SRM since 2021. This is organised in the context of the annual Resolution Planning Cycle (RPC) and follows a staggered approach (see chart below), supported by structured feedback from those teams at the SRB and the relevant NRAs who are preparing a bank’s resolution plan, so that banks themselves can address the issues encountered during the bail-in testing exercise. This iterative process is an important element to steadily improve banks’ readiness and provide evidence that what is described in the playbooks and discussed in workshops can be executed in practice. This is a joint learning process where we receive important insights to ensure readiness on the authorities’ side.

Bail-in testing sequence between 2021-2024

All this happens against a legally complex background: the application of the bail-in tool requires adherence to many provisions in EU and national law.

3. Better transparency on bail-in decisions and execution

The decision to apply bail-in to a failing bank is taken by the SRB at Banking Union level. However, the bail-in decision needs to be implemented by the NRA at national level, taking into account the national legal framework, including insolvency and securities law. Due to the complexity of a bail-in – resulting, for example, from insolvency laws not yet harmonised across the EU – considerable coordination efforts are required by involved public authorities. To improve transparency and predictability, the European Banking Authority (EBA) asked resolution authorities, starting this year, to publish their bail-in mechanics, describing how a bail-in would be executed. NRAs are in the process of publishing the approach to bail-in in their respective jurisdictions. In light of the complexity of the operationalisation of this legal procedure, it is crucial to understand the bail-in process in its entirety, including the interaction of SRB and NRAs, which is described in a dedicated SRB publication.

Banks have made huge progress on bail-in readiness over the last few years. This is good news. However, there are also banks lagging behind. In addition, there are areas where more work is needed on both the banks’ and the regulators’ side. This concerns, for instance, the involvement of external stakeholders, such as Central Securities Depositories (CSDs) and various operational agents, and ensuring that banks are ready to comply with third countries’ securities markets laws, to provide more clarity and certainty to bail-in in a cross-border context.

This makes it clear that we cannot pause or slow down the work. Bail-in is one of the main tools in the SRB’s toolkit that ensures loss absorption is not borne by the taxpayer. In the future, the SRB, in close cooperation with NRAs, will continue its efforts and investigate further means to guide banks towards closing remaining gaps on bail-in operationalisation. This is also in line with the SRM’s new strategy, SRM Vision 2028, which places emphasis on operationalisation and testing of bank-specific resolution strategies. Finally, we will also assess whether more flexibility for the definition of resolution strategies and the combination of resolution tools could further increase crisis readiness to ensure an agile toolkit that can be effectively applied to a failing bank under the circumstances at that time.

Recently on our blog

Smaller banks, also known as less significant institutions (LSIs) in the Banking Union, play an important role in the financial ecosystem. They provide essential services that support local economies and communities such as payment services, deposit...

Banks’ trading activities can carry a substantial part of their total risk and be a channel of contagion in bank crises. A keen understanding of what’s in trading books and of how to wind them down post resolution while staying solvent is key for a...

About the author