Today, the SRB has published a document for banks, investors and other stakeholders on executing its bail-in decision, as well as links to national resolution authorities’ mechanics for bail-in (in line with EBA guidelines).

Bail-in is a key resolution tool in a banking crisis, in order to absorb losses and recapitalise failing banks. It allows the write-down of debt owed by a bank to creditors or its conversion into equity to absorb losses and stabilise the bank. The mechanics of how bail-in is applied to a bank under resolution is defined by each national authority in line with its national legal framework.

“Shared understanding and coordination around bail-in are essential for successfully resolving banks, without the impact falling on the taxpayer or financial stability. This document and the national bail-in mechanics bring more transparency about how bail-in works in practice, and particularly in a cross-border group,” said SRB Chair Dominique Laboureix.

Further information on the national bail-in mechanics in the various jurisdictions of the BU can be found on the SRB’s website.

Contact our communications team

Recent press releases

- Valuations are a critical component of successful bank resolution, forming the basis for resolution authorities’ decisions in crisis cases

- The...

Miguel Carcaño Saenz De Cenzano to become new SRB Vice-Chair

Slavka Eley and Radek Urban to join SRB as new Board Members

The Single Resolution Board...

- The consultation emphasises the importance of banks regularly testing their capabilities to handle a resolution action in case of crisis

- The consultati...

Related news and press releases

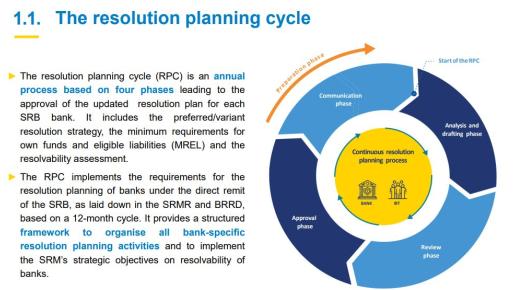

Find out more about the SRB’s 2024 resolution planning cycle (RPC) in our new publication. The SRB launched the RPC for banks under its remit in April...

- The SRB is extending the deadline for the minimum bail-in data template (MBDT) public consultation to 15 May 2024, offering stakeholders additional...

The SRB has published its Resolution Planning Cycle Booklet for 2023.

Resolution planning is about being prepared to deal with failing banks in a...